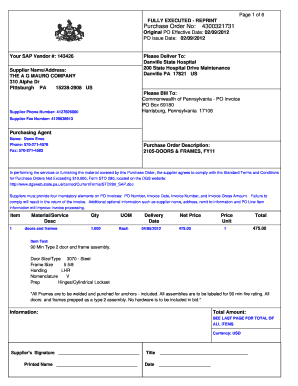

List physical inventory by item number, name, description, type, and location, and record purchases, including purchase dates, vendors, and prices. Compare the number of items sold to your monthly sales figures to make sure your inventory tracking sheet matches actual sales. Customize with a logo and business details, and enter an invoice number, date, customer ID number, and payment terms for each invoice.

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/trading_instruments.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

Contributing to a tax-advantaged account, such as an IRA or 401k, can reduce your taxable income—a great way for those who are self-employed to save on taxes. These are directly related to the cost of goods sold or items and storage paid to sell your products. For a commercial space, utilities such as electricity, internet, sewage and trash pickup fees are fully deductible. For a home office, you can deduct utilities in proportion to how much of your home is used for business. Monthly telecommunications fees in a commercial space can be deducted, as can additional phone lines in a home office as well as cell phone contracts as a subcategory of office expenses.

Bookkeeping vs. Accounting

Your Guide to Running a Business The tools and resources you need to run your business successfully. Your Guide to Starting a Business The tools and resources you need to get your new business idea off the ground. Digital asset management Manage and distribute assets, and see how they perform. Kelly is an SMB Editor specializing in starting and marketing new ventures.

Can help you make sense of your financial reports, review your budget, and prepare for taxes. Don’t forget to visit the QuickBooks bookkeeping hub where you can find additional helpful information and definitions. The Net Present Value of your business is a calculation that helps you analyze potential projects or investments that might be worth your while.

The Beginner’s Guide to Bookkeeping

A clear picture of your income within a specific quarter makes it easy to figure out how much tax to pay for that three-month period. At the beginning of the year, take a look at the list of deductible expenses and determine which categories you’re most likely to spend money in. Consider creating a labelled file folder for each of these expense categories.

Compensation can even extend to salaries paid to children and spouses, provided payments were made through payroll and those individuals performed services for your business. Attention to expense deductions may not play a prominent role in the financial planning process for small businesses and startups—and that may be costing them. Sure, you’re focused on customer service and improving your products and services. Generally speaking, bookkeepers help collect and organize data and may have certain certifications to do so for your business. On the other hand, accountants are generally equipped with an accounting degree and may even be state-certified CPAs.

Additional Resources

The template keeps a running subtotal of expenses, adjusting the total sum with each new entry. However, if your business is incorporated, or if it’s your sole source of income, the single-entry method just won’t cut it. The double entry method leaves less room for error, making it the better choice for balancing complex books.

To learn more, check out CFI’s free tutorial on how to link the three financial statements in Excel. This simple but comprehensive template allows you to create a 12-month cash flow forecast for your small business. The spreadsheet includes monthly columns for recording forecasted and actual cash flow. List cash receipts and cash paid out to view your projected and actual cash position for each month. Track the value of your current inventory and determine the cost of goods sold with this inventory tracking template.

Chart of Accounts Template

https://bookkeeping-reviews.com/s older than six years can be securely disposed of by hiring a professional document shredding company. For digital records, QuickBooks allows you to easily delete or condense historic transaction data to save you storage space and secure sensitive financial information. The second line is for the credit entry – the account that the money came out of to pay for the expense. Once again, this credit entry in the Details column is indented so that it is easy to see compared to the debit entry and so we know it goes on the right-hand column of the ledger. It is the method of documenting the daily financial transactions of an organization.

One of the easiest ways for business owners to categorize expenses and track spending is to use accounting software, which often has prepopulated business categories. You can amend or add as needed, and it will automatically compile transactions. Reviewing financial accounts is a good habit that will encourage you to stay on top of your expenditures. Reconciling bank statements can be easily done using accounting software. If you find you’re having challenges, a business-only credit card is a top expense management best practice.

This template allows you to track the variance between your projected and actual cash position for each month and calculates total cash payments and net cash change. You will likely want to establish a business banking account and credit card. This can help you keep your own business expenses organized and separate. If you plan to hire employees, such as an administrative assistant, you may also want to seek a small business loan. If you seek funding from a bank or investor, your business plan will be especially important because it is how potential lenders and investors will understand your business. If you’re considering becoming a bookkeeper, read our guide to learn how to start a bookkeeping business in 2023.

You can also deduct payments made to employees to reimburse them for relevant educational expenses. This covers the cost of items and services to directly promote or market your business. Examples include fees paid to advertising or marketing companies to produce promotional materials, billboards, brochures, posters, websites and social media images. As a business owner, it is important to understand your company’s financial health. Bookkeeping puts all the information in so that you can extract the necessary information to make decisions about hiring, marketing and growth.

Changes to parks, elected positions eyed by council – The Daily Times

Changes to parks, elected positions eyed by council.

Posted: Wed, 15 Mar 2023 05:32:31 GMT [source]

Consider whether your budget allows for paid advertising and marketing materials. Develop an online presence with a website that is optimized for search. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Read our editorial process to learn more about how we fact-check and keep our content accurate, reliable, and trustworthy.

Saving your records in the cloud also ensures that they’re easily accessible in a digital format from any device. Making sure your records are well-organized can save you a big headache if you’re ever subjected to an audit. You could have a cashbook with more than one income or expense column as in this bookkeeping example below. It’s called single-entry bookkeeping and is the simplest method of bookkeeping. It is possible to maintain a manual cashbook for a small business and produce a Profit and Loss Report from just the cashbook without having journals and ledgers. The net profit is calculated by subtracting expenses away from income; it comes to $75.00.

In single-closing stock, opening stock bookkeeping, each transaction is recorded as a single entry in a ledger, while in double-entry bookkeeping, a transaction is recorded twice. For example, if you make a $30 sale, in the double-entry system that transaction could be recorded as a gain in your income ledger, and as a deduction to the total value of your inventory. You want to spend less time on record-keeping and more time on your business.